The IndoSpace Quarterly, March 2021

From supportive government policies to an expected increase in domestic demand, various factors suggest that 2021 is going to be a year of positive change for the warehousing and logistics industry. With this newsletter, we peek into the imminent trends and the way forward after an eventful year.

|

|

|

|

|

|

|

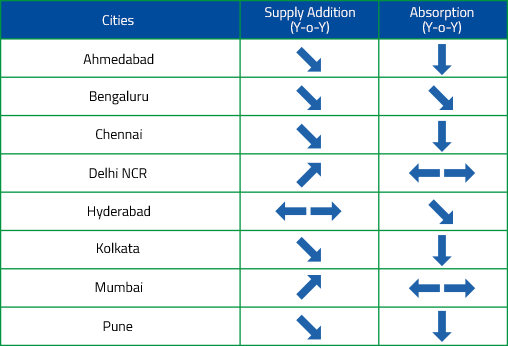

Due to the COVID-19 induced lockdown and subsequent disruption of operations across industries, the warehousing sector in India witnessed a dip in project completions and absorption levels. However, the recovery was neither too far nor too sluggish. By the time the lockdown was completely lifted in Q4, the market started gaining momentum with highest supply and absorption numbers of the year.

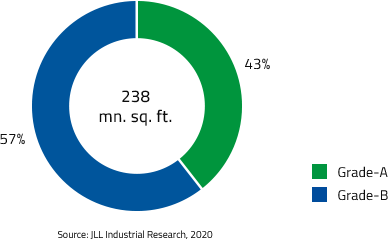

JLL India Industrial Services reports that 2020 saw a 13% y-o-y growth in the total stock of Grade-A and Grade-B warehousing space in the top eight cities. The overall warehousing space stands at 238 mn. sq. ft. at the end of 2020 compared to 211 mn. sq. ft. in the previous year. Supply and demand (net absorption) clocked 27 mn. sq. ft. and 22 mn. sq. ft. respectively, a reduction of more than 35% y-o-y from 2019.

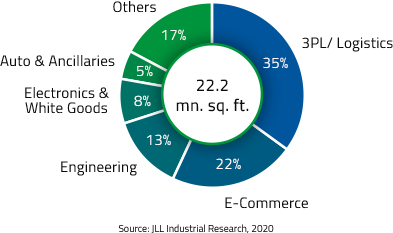

It is interesting to note that Grade-A properties have particularly been in demand. Adherence to additional hygiene and safety norms by Grade-A park developers has played a major role here. Not surprisingly, 56% of the total net absorption in 2020 was observed for Grade-A spaces. 3PL followed by e-commerce have emerged as the largest occupiers of warehousing space in India, and together contributed to 57% of the total net absorption in 2020.

Snapshot of the key trends that define

the sector's performance in 2020

|

|

Sector-wise net absorption, 2020 |

|

|

|

|

|

|

|

|

|

One of the promising fields in the logistics industry that is gaining increasing relevance as well as importance by the day is cold chain logistics. The Indian cold chain market was estimated to be worth USD 19.6 Billion in 2020 and is further projected to reach USD 36 Billion by 2024, growing at a CAGR of 16% (Source: ISHRAE - Indian Cold Chain Industry Outlook 2024).

Simply defined as the transportation and warehousing of temperature-sensitive products from the point of origin to the point of consumption, cold chain is a pivotal process because it prevents large scale spoilage by increasing the shelf life of products. This is especially relevant to fruits and vegetables, milk and milk products, poultry and processed meat, marine products, pharmaceuticals (mainly vaccines) and chemicals, some of which are classified as essential products.

The cold chain industry comprises of two segments:

1. Storage – Temperature Controlled Warehousing (TCW)

2. Transportation – Temperature Controlled Transportation (TCT) with Reefer Vans

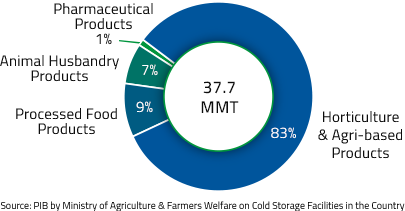

The cold chain industry in India is still at a nascent stage. There are 8,186 cold storage facilities with a capacity of 37.4 Million Metric Tonnes (MMT) available in the country (Source: PIB by Ministry of Agriculture & Farmers Welfare on Cold Storage Facilities in the Country). A massive 83% of these facilities store perishable horticulture produce such as fruits and vegetables.

|

Cold storage utilisation in India, 2019 |

|

|

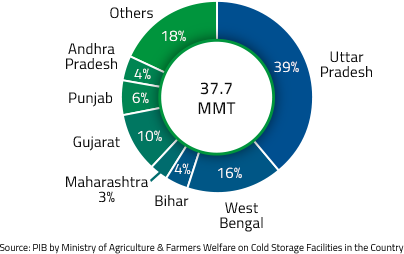

State-wise availability of cold storages in India, 2019 |

|

About 55% of cold storage capacity is concentrated in the states of Uttar Pradesh and West Bengal, where-in storage of potatoes accounts for 85-90% of the capacity. Cold storage units in Maharashtra, Gujarat and the southern states mainly cater to dairy products, fruits, processed fish and meat products and seasonal vegetables. Although, cold storage contributes 43.7% of the total revenue from Indian cold chain industry, 36% of the cold storages in India have a capacity below 1,000 MT.

|

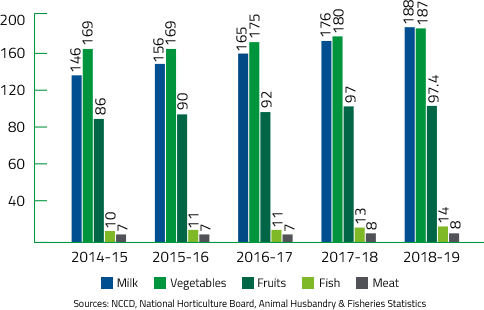

Perishable goods production in India (MMT) |

|

There has been a steady increase in the production of perishables since 2014–2019. But a similar growth isn’t reflecting in the cold chain potential owing to a host of reasons. High share of single commodity storage as well as high initial investment for land and refrigerator units is one of the key causes. What adds to it is the lack of necessary enabling infrastructure and the awareness for handling perishable goods. Lastly, lapses in service by storage and/or transportation providers leading to inferior quality goods is a major challenge.

|

|

|

|

|

|

|

|

|

|

|

|

Continuing its pan-India expansion, IndoSpace has acquired land for three new industrial and logistics parks in Luhari, Oragadam and Vallam – adding approximately 172 acres to its portfolio. These locations will boost IndoSpace’s footprint across regions while attaining its long-term goal of 120 mn. sq. ft. of logistics infrastructure across India.

|

IndoSpace Logistics Park Luhari IV | 55 Acres |

Located on MDR-132, IndoSpace Logistics Park Luhari IV is 20 km from Bilaspur Chowk on the Delhi-Jaipur Highway (NH-8). The site has excellent connectivity to Gurgaon and Delhi via major national highways such as NH-8 (Delhi to Mumbai) and NH-71 (Rewari to Rohtak), providing access to important consumption markets in north India. This location has proved to be ideal for companies looking to set-up warehousing and distribution centres in NCR and enjoys a very well-developed social infrastructure.

|

IndoSpace Park Oragadam III | 68 Acres |

This park is located off SH-48 and offers superior connectivity to the city of Chennai through the Outer Ring Road. It is also strategically positioned close to Chennai Airport (38 km) and Chennai Seaport (58 km). IndoSpace Park Oragadam III is also close to the established industrial area and automobile hub of Oragadam (4 km) and Sriperumbudur micro-market and provides proximity to OEMs like Royal Enfield, Nissan, Daimler, Hyundai and Foxconn, as well as their component suppliers.

|

IndoSpace Vallam II | 50 Acres |

The park is located in SIPCOT industrial area at Vallam, off SH-57, in Kancheepuram district. The area is near the established industrial and automobile hub of Sriperumbudur (11 km) and Oragadam micro-market (10 km) and is well connected to Chennai city (52 km), Chennai Seaport (56 km) and Chennai Airport (39 km).

|

|

|

|

|

|

|

|

|