- Make in India- Looking Back at

the Last 5 Years

- What’s New in

Industrial Real Estate for Industry 4.0

- Material Handling Tips

for Maximising Warehouse Space

- Spaces on Lease

for Light Manufacturing Occupiers

- Market Movement in India & IndoSpace Park Launches

MAKE IN INDIA-

LOOKING BACK AT THE LAST 5 YEARS

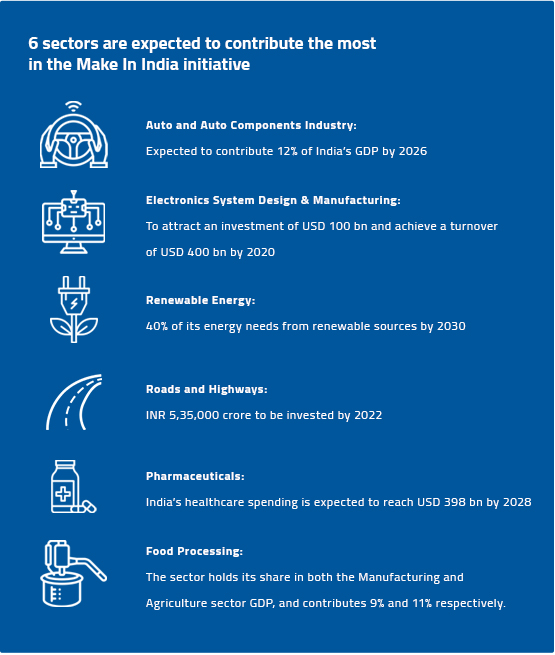

The Make in India initiative was launched by the Government of India, in September 2014, with a vision to transform India into a global design and manufacturing hub. The initiative started by building confidence amongst potential foreign partners and the Indian business community, focusing on 25 different industry sectors.

The Government of India is pushing to achieve its vision of a ‘5 Trillion Dollar Economy’, by introducing measures like infrastructure investments, standard and dedicated logistics policy, simplification in tax structure, support to MSME entrepreneurs and rural empowerment initiatives.

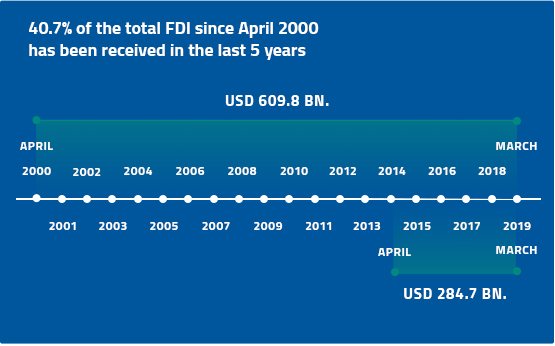

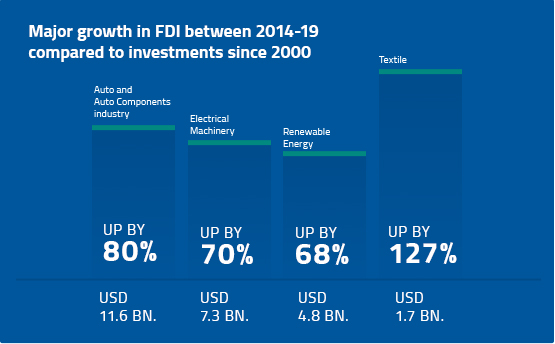

In 2019, 5 years after the launch of Make in India, here are some of the key outcomes:

What’s New in

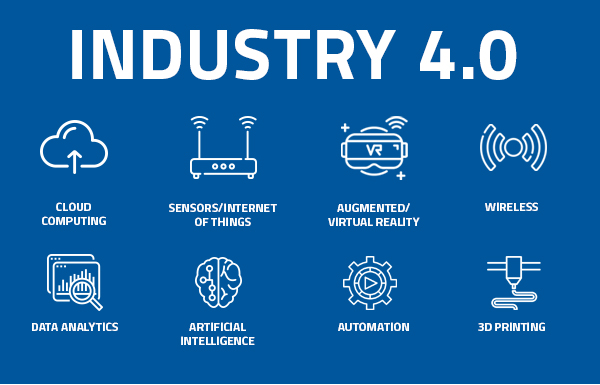

Industrial Real Estate for Industry 4.0

Considering the volume of data that real estate and its users generate, it seems likely that companies specialising in Big data processing domain will enter the real estate services market. These companies have established data-supported business models and the financial ability to acquire technologies that can help them break into new markets. This will put them ahead of many incumbent firms, which face a learning curve in adopting data as a business model.

Real estate service providers may need to reinvent their value proposition for Industry 4.0. Big Data can enable this through different technology disruptions like:

Here are some other significant innovations influencing the construction and management of real estate across the globe.

Robotics:

Robotics is becoming an attractive solution for the construction and management of real estate.

The applications include:

- Surface cleaning

- Security services

- Façade cleaning or painting (by drones)

- Inspection of hard-to-reach exteriors (e.g., transmitter masts)

Augmented and virtual reality:

The use of AR/VR is reinventing administrative functions such as order planning and processing. This technology enables workforce management, route optimisation; and resource planning. It can also bridge the gap in on-site expertise by bringing in remote technicians via tele-guidance. AR/VR can help optimise product management and logistics through enterprise resource planning systems, thereby freeing on-site employees for higher-value work.

Sensor technology:

Sensors can help real estate service providers pinpoint trouble spots, identify their causes, and order repairs - all in one go. By analysing data gathered through sensors (date of last maintenance, for instance, or day-to-day resource consumption), providers can also align their services with the users’ requirements and improve customer satisfaction.

Internet of Things:

The Internet of Things (IoT) can be used for detecting debris and deploying housekeeping robots for cleaning. Similarly, sensors in potted plants can be used for communicating with automated water sprinkling systems. IoT is the underlying principle of intelligent building automation.

Building information modelling:

One can monitor construction projects more efficiently, keeping them within the specified timeframe and budget. This technology also supports building management by providing precise information around the structure, piping, cable paths, and other bottlenecks around the facilities.

Material Handling Tips

for Maximising Warehouse Space

Warehousing space is precious, and every square foot counts. How one manages the space at their disposal determines the efficiency of their operations. While one may want to have an expansive, endless warehousing space, the reality is that warehousing space is always limited. However, one can maximise the use of space by making a few changes, as given below:

Go Vertical:

Go Vertical:

Instead of building out or buying extra space, take advantage of space by embracing vertical storage. Taller storage units allow maximum use of space. With material handling equipment such as mezzanine shelving, it is possible to make use of the available space without having to expand the building.

Consolidate Locations:

Consolidate Locations:

If the same item is stored in multiple locations, consider consolidation for better warehouse space utilisation. This can be done during the put-away process and as a standalone function.

Right-Size Storage Slots:

Right-Size Storage Slots:

Match the size of an item with the number of orders (sales), to find the right-sized pick slot, in order to maximise the utilisation of pick slots. The same logic applies to reserve storage locations for all SKUs, wherein maintaining 4-7 days of stock for fast-moving SKUs in a forward-pick area, can reduce replenishment cycles.

Optimal Aisle Width:

Optimal Aisle Width:

One way to maximise warehouse efficiency and storage space involves measuring the width of aisles. Wider aisles make it easy for employees – and warehouse storage equipment such as forklifts – to move through the space. But the investigation into aisle width should also look at how storage shelving is laid out. Reworking the layout of the warehouse may be an investment, but it’s one with a fast return, giving more storage flexibility and safer, more efficient operations.

Evaluate Material Handling Equipment:

Evaluate Material Handling Equipment:

How much time is spent repairing storage and material handling equipment? What does it cost to maintain it, and does this maintenance save time and money, and improve efficiency? If we find that maintenance and repairs are slowing down operations or costing too much, then we may want to consider newer material handling technologies

Streamline Inventory:

Streamline Inventory:

Having too much inventory in the warehouse can slow down operations. Storing goods in aisles or on docks can disrupt operations and present a safety hazard. With new storage designs, we can identify bottlenecks in the system and make sure that the warehouse is more organised and efficient.

Switch to Reusable Packaging:

Switch to Reusable Packaging:

Many companies have cut costs and improved efficiency by switching to reusable packaging i.e., packaging made from durable materials designed to survive multiple trips. Reusable packaging can lead to more efficient transportation, lower waste management, labour costs, and reduce storage space requirements. Besides, using reusable packaging is good for the environment and the planet.

Is the Warehouse Full or Just Disorganised?

Is the Warehouse Full or Just Disorganised?

Many warehouses that seem full are just disorganised and have insufficient storage. Some other ways of improving warehouse space utilisation include:

- Separate shipping and receiving docks can be combined to save space.

- If building layout permits, a mezzanine floor can be used to house products that do not require high-bay storage. These can be expensive and permanent but will maximise warehouse space utilisation.

- Reduce over-stocking for packaging material. Suppliers of corrugated material may be persuaded to keep some inventory at their site and organise delivery every few days.

Off-site Location for Excess Stock:

Off-site Location for Excess Stock:

If some items need to be stored in large quantities, one can consider off-site storage for the excess stock, thus freeing up space for fulfilment operation. Crossing docking can be used for large releases of back orders or single-line orders, to reduce the amount of inventory required to be stored on-site. The Pareto Principle states that 80% of the activity in a warehouse comes from 20% of the items, and these items are the fast-movers within the warehouse. The next 15% of the activity comes from 30% of the items, which are the medium-movers. Finally, 5% of warehouse activity comes from 50% of the items, which are the slow-movers. Material handling, if managed correctly, can improve overall productivity and profitability dramatically.

Spaces on Lease

for Light Manufacturing Occupiers

The light engineering industry is one of the largest contributors to India’s industrial growth and operates as an intermediary to other core industries like power, mining, oil and gas, consumer goods, automotive, and the general manufacturing sector. In addition to conventional, non-technology-based manufacturing, the industry is also inclined towards tech-driven manufacturing for defence and auto.

The light manufacturing sector relies on city-centric built spaces and government-sponsored industrial clusters/parks as the most preferred locations for operations. Uninterrupted supply of water, power, and fuel for 24*7 operations, good connectivity by roads, fire-fighting systems, and compliant facilities are key to this sector’s success.

Most light engineering sector units incur the entire CAPEX towards the creation of real estate platforms, in addition to the applicable land cost. To minimise the initial capital outflow, the sector is inclined towards leasing space from organised industrial/warehousing real estate providers.

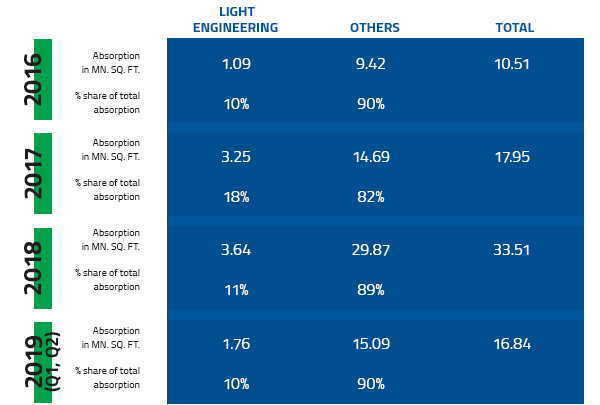

JLL research indicates that 12% of total cumulative organised private industrial and warehousing space is occupied by Light engineering manufacturers (15.7 MN. SQ. FT. by Q2, 2019), with a CAGR of more than 30% in the last 3 years. These are primarily on lease basis and average 50K to 100K SQ. FT. built-up space. The units largely cater to auto ancillary, hi-tech electronics, and consumer goods sectors.

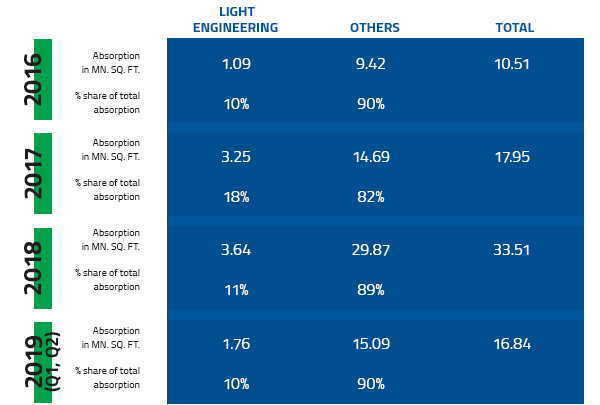

The Y-o-Y absorption of built up space by light engineering sector is shown in table below:

Key reasons behind this sector’s increasing preference for leasing ready spaces are:

- Easy detection of suitable locations near core-industrial units

- Minimum initial CAPEX requirement for land and construction cost

- Less time for construction and no loss in related costs for approval

- Ready-built facilities with compliances related to safety and security

- Commonly managed maintenance

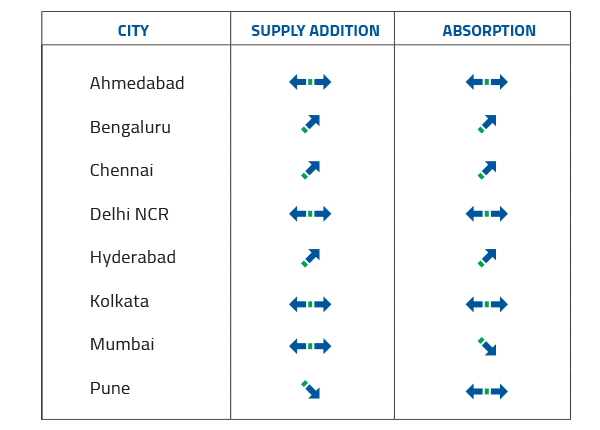

industry market movement 2019 (Q3) across india

IndoSpace Launches 2 New Parks in South India

IndoSpace strengthened its footprint in South India with the launch of two news parks near Chennai. With over 10 million square feet of space and 15 Grade A parks, IndoSpace continues to maintain its #1 position in South India. Spread across an area of over 15 acres, IndoSpace Industrial Park Meva is located near NH-48, in Mevalurkuppam village of Kancheepuram district. With its close proximity to the Irungattukottai micro-market (known for supporting the auto and auto-ancillary units in Sriperumbudur-Oragadam area) and the manufacturing plants of major auto brands, IndoSpace Mevalurkuppam is ideally located to support this sector’s industrial space requirements. IndoSpace Sugal Industrial Park Koodapakkam is spread across 26 acres and is located in the Tiruvallur district in the state of Tamil Nadu. It is situated on SH-50 and is close to NH-332, which runs across Tamil Nadu and Puducherry, providing excellent road connectivity within the state. With the Chennai airport just 40 km away, Chennai port 38 km away, and the industrial areas of Irungattukottai, Mahindra World City, and Gummudipoondi close by, IndoSpace Koodapakkam is extremely well located.

In addition to the above, other industrial & logistics parks developed and operated by IndoSpace in South India include;

- Industrial and Logistics Park Oragadam (4 Parks, Tamil Nadu)

- IndoSpace Industrial Park Coimbatore (Tamil Nadu)

- IndoSpace Industrial and Logistics Park Vallam (Tamil Nadu)

- IndoSpace Logistics Park Puduvoyal (Tamil Nadu)

- IndoSpace Industrial Park Polivakkam (Tamil Nadu)

- IndoSpace Logistics Park Nelamangala (Karnataka)

- IndoSpace Industrial and Logistics Park Narasapura (Karnataka)

- IndoSpace Logistics Park Bommasandra (Karnataka)

- IndoSpace Industrial and Logistics Park Sri City (2 Parks, Andhra Pradesh)

|

|

Disclaimer: This newsletter has been produced solely as a general guide and does not constitute advice. We have used and relied upon information from sources generally regarded as authoritative and reputable, but the information obtained from these sources has not been independently verified by Jones Lang LaSalle & IndoSpace. Whilst the information contained in the newsletter has been prepared in good faith, and with due care, no representations or warranties are made (express or implied) as to the accuracy, completeness, suitability, or otherwise of the whole or any part of the publication. Jones Lang LaSalle & IndoSpace, their officers and employees, shall not be liable for any loss, liability, damage, or expense arising directly or indirectly from any use or disclosure of or reliance on such information.

|