The COVID-19 pandemic has taken the world through unprecedented times and changed the way we have been doing business. This newsletter comes to you at a stage where the industry is going through an evolution, where adapting to change and acting on it is of utmost importance.

In the sections below, we cover topics that provide an understanding of how the pandemic has affected our industry and what can be the best way forward.

in a Post-COVID-19 World

The Indian warehouse market is in the stage of evolution, positioned to take the leap from mechanised warehouses to automated warehouses.

Mechanised warehouses substitute manual power with machines. In contrast, automated warehouses extensively use conveyors, sorting equipment, Automated Storage and Retrieval Systems (AS/RS), and other material handling equipment.

However, two major factors that have limited adopting automated technologies in Indian warehouses are:

Availability of LabourUrban areas of India reached an unemployment rate of 23.7% in 2018, giving access to abundant work force.

Low RoIThe Return on Investment (RoI) for automation equipment is much harder to achieve with high costs of implementation

![]()

The outbreak of COVID-19 has only made the situation more challenging. As migrant workers, operating on daily wages, go back to their hometown, warehouse operators realise the importance of automation in the long run. COVID-19 is catalysing mechanisation and eventually, the automation process in warehouses.

As some companies have recently started moving towards automation, we expect the trend to increase hereon, especially post-COVID-19. Some of the cases are as follows:

- Asian Paints has expanded their warehouse facility in Rohtak with pallet conveyors, fully automated and controlled warehouse control systems as well as AS/RS systems.

- Marico Ltd. has adopted fully managed, highly-elastic, warehouse-as-a-service cloud-based relational database, which has helped the company to increase its data processing speed by over 150%. This has given Marico more agility in business decision-making during critical times

Greater automation (touchless logistics / Contactless logistics) with robots working in warehouses could be the way forward in the long term. However, the whole process of shifting to entirely automated warehouses may take some time due to the cost and time involved in implementation.

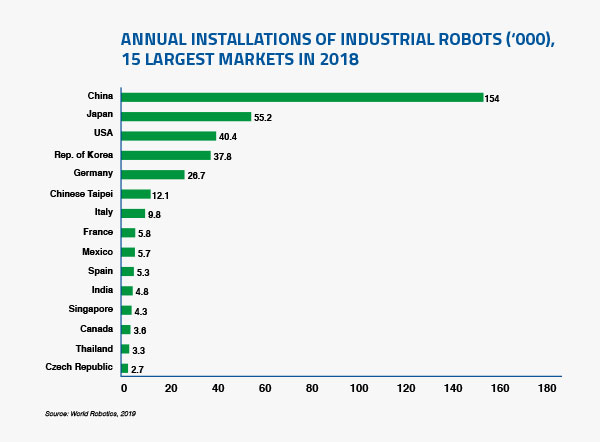

In 2018, India reached 4,771 industrial robots sales, an increase of 39% compared to 2017. What’s more? Warehouse automation is in line with the social distancing norms and also helps in mitigating the labour shortage problems.

Some of these alternatives to manual labour can increase the efficiency of a warehouse in the long run:

- Automated Storage & Retrieval System (AS/RS):

A type of warehouse automation technology specifically designed to buffer, store and retrieve product and inventory on demand. It includes shuttles, cranes, Vertical Lift Modules (VLMs), micro-loads, mini-loads, unit-loads, or other mechanical systems integrated with a Warehouse Execution Software (WES) or Warehouse Management System (WMS). - Automated Conveyor System:

Mechanical devices or assemblies to safely and efficiently transport material through the distribution process with minimal effort. - Automated Sorting System:

Automated system of separating products from in-feed conveyor lines to shipping lines, palletising operations, packing stations and other sortation applications.

Social distancing has become crucial during the COVID-19 pandemic. Redesigning warehouse facilities helps protect workers and ensures that picking, shipping, and delivery, all can be carried out smoothly on time. Warehouse operators are looking to introduce a variety of measures such as dividing operating hours into distinct shifts, separate picking and packing zones, reducing travelling of workers all over the warehouse.

![]()

COVID-19 has also impacted the traditional ways of managing the supply chain. Companies have realised that they require resilient supply chains in the future. As a result, currently, they are searching for easily implementable solutions to counter short term COVID-19 related supply chain disruptions.

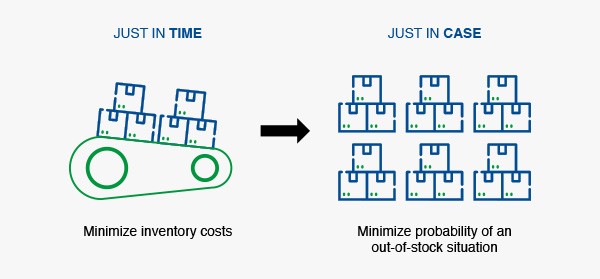

Less 'Just-In-Time' and more 'Just-In-Case' Inventory ManagementInitially, Just-In-Time shipment delivery with tight inventory-to-sales ratios were the priorities to reduce inventory carrying cost and efficiency. It is a management system that orders parts and products from suppliers only as required to meet the immediate customer demand.

However, COVID-19 may shift the focus to a more conservative, inventory stock and supply strategy. Going forward, companies would prefer keeping higher inventories, thereby increasing the demand for warehousing space. It has become essential to maintain additional stocks of critical items. This gives rise to Just-In-Case strategy.

What is Just-In-Case?Just-In-Case (JIC) is an inventory strategy in which companies keep large inventories on hand. This type of inventory management strategy aims to minimize the probability that a product will sell out of stock. The company that utilizes this strategy likely has a hard time predicting consumer demand or experiences large surges in demand at unpredictable times. A company practicing this strategy essentially incurs higher inventory holding costs in return for a reduction in the number of sales lost due to sold-out inventory.

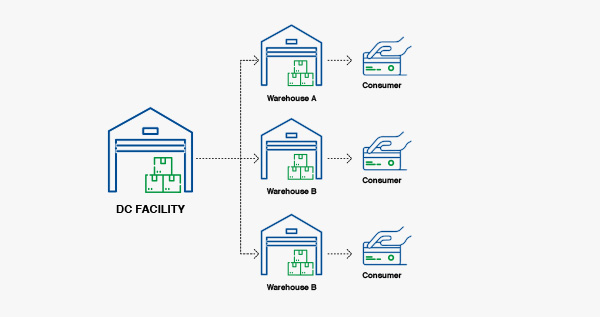

From a Single Warehouse to Multiple Warehouses at Different LocationsCOVID-19 has compelled the warehouse occupiers to rethink their strategy of having one consolidated warehouse for supplying products to consumers. Consolidating warehouses at a single location posed challenges due to the lockdown. In such cases, it is better to have decentralised inventory system which uses smaller, regional-based facilities to speed up shipping products to their customers. Through this system, companies can still operate through other warehouses if a certain area is locked down.

Advantages of decentralised inventory system

- Fast Shipping

- Saving Money for the Seller

- Distributing Risk

- Increasing Efficiency

Expand volume of ready-to-deliver inventory

Currently, warehouses in most Indian cities are located away from the consumer base. Due to the lockdown and social distancing, there is a high demand for last-mile delivery and one-day delivery. Resulting in an increased demand for in-city warehouses which are located near the consumer base to reduce delivery time and transportation costs.

COVID-19 has impacted consumers' purchase decisions in Q1 FY21. This is evident by higher spends on health and hygiene products, purchase of essential items, and preference for home deliveries.

Purchase of essential itemsCOVID-19 has negatively impacted people's finance; therefore, there is a shift to mindful spending and buying less expensive products.

- The expenses are mostly on essentials, including groceries and household supplies, personal and home care products, and not on discretionary products

- This trend will continue post-COVID-19 due to conscious shopping.

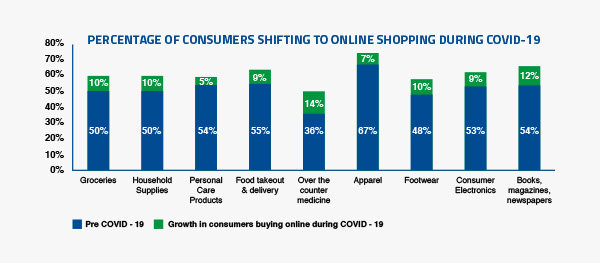

Moving towards online purchases

- Many e-commerce categories are expected to boom, as people make a behavioural shift from buying offline to online.

- COVID-19 has accelerated e-commerce adoption rates, leading to an increase in the demand for online delivery of essential and non-essential items. Unified Payments Interface (UPI) recorded transactions worth USD 30.97 bn in May 2020 in India compared to USD 29.22 bn in March, 6% increase in just 2 months during the lockdown period. (Source: IBEF)

- New consumers started migrating online for grocery shopping, a trend which is most likely to be sustained post-COVID-19. Online grocery platforms like Grofers and Big Basket have witnessed an increase in new users by 14-15%, and the number of orders from the existing users has doubled during the lockdown period.

- Contactless delivery and drive-through services, are also witnessing higher adoption rates. As consumer behaviour is shifting beyond survival mode, the digital-adoption momentum is likely to carry forward and become permanent.

The rise of local shoppingThere is an increase in shopping locally from neighbourhood retail shops which saves travel time and is safer.

- These local stores stock 95% of India’s food and grocery inventory (source: ASSOCHAM and MRRS India), and the majority of the population are dependent on them for buying daily essentials.

- It is leading to the growth of wholesale online marketplaces that work with local stores and provide supplies of branded products to them. Omni-channel marketplaces, such as Metro Cash & Carry witnessed a steep increase in sales by 30% per consumer from mid-March 2020, which further rose by another 30% by end-March 2020.

COVID-19 has forced these trends on consumers, retailers and warehouse operators in Q1 FY21, and, are anticipated to continue in the long run.

Continuing its pan-India expansion, IndoSpace has commenced five new industrial and logistics parks in Taoru, Luhari, Anantapur, Vishnuvakkam, and Becharaji – adding approximately 252 acres to its portfolio. These locations will boost IndoSpace’s footprint across regions while attaining its long-term goal of 120 mn. sq. ft. of logistics infrastructure across India.

Taoru | 53 AcresSituated 20 km from Gurugram, this Grade A park is the gateway to NCR, a region with a high consumption market. IndoSpace Logistics Park Taoru is located on NH-919 – the national highway connecting Faridabad Palwal (NH-02) and Manesar (NH-48) in Haryana. With its proximity to the KMP, NH-248A (Sohna-Gurgaon) and NH-48, this location gives excellent road connectivity through a well-developed network into NCR.

Luhari III | 64 AcresLocated on the Bilaspur-Pataudi Road (MDR-132), this built-to-suit facility is just 18 km from Bilaspur Chowk, located on the Delhi-Jaipur highway. Offering excellent connectivity with Gurugram and Delhi, through NH-48 (connects Delhi to Mumbai) and NH-352 (erstwhile NH-71), the park provides access to important consumption markets in North India. Luhari is a proven location for companies to set-up warehousing and distribution centres. Due to the dearth of Grade A facilities here, IndoSpace becomes the foremost solution to anyone seeking world-class warehouses in the region.

Anantapur | 29 Acres This Grade A park is located in the village of Munimadugu, off NH-44, within 5 km from the KIA Motors plant and 40 km from the Andhra Pradesh Aerospace & Defence Electronics Park. Anantapur is an upcoming industrial zone on the Hyderabad-Bengaluru highway, NH-44. The city is home to several manufacturing units of leading names like Berger Paints, Page Industries, Bharat Electronics Limited (BEL) and Stumpp Schuele Casings (SSC).

Vishnuvakkam | 62 Acres This Grade A park is located in the village of Munimadugu, off NH-44, within 5 km from the KIA Motors plant and 40 km from the Andhra Pradesh Aerospace & Defence Electronics Park. Anantapur is an upcoming industrial zone on the Hyderabad-Bengaluru highway, NH-44. The city is home to several manufacturing units of leading names like Berger Paints, Page Industries, Bharat Electronics Limited (BEL) and Stumpp Schuele Casings (SSC).

Becharaji | 44 Acres At Becharaji, IndoSpace is the only provider with 44 acres of Grade A facilities suitable for industrial, warehousing and logistics development. The park is strategically located, in close proximity to both industrial hubs and transportation networks. Situated just 9.5 km from the Maruti Suzuki plant, the park has direct access to SH-19 and enjoys good visibility from the highway.

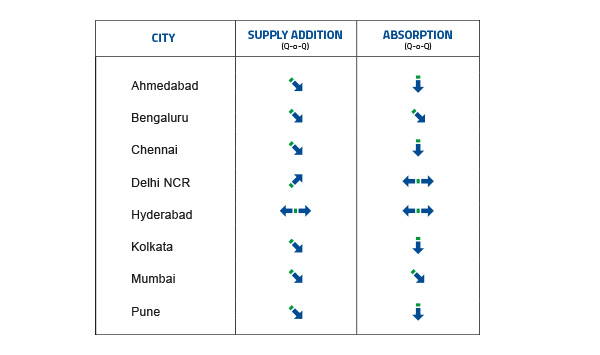

absorption data for all metros